The draft law introducing the amendments to the annual property tax (“ENFIA”) has been published. The amended tax is effective from 1 January 2022. The overall purpose behind the amendments is:

- to neutralise the impact of the recent increase of the statutory values that are in effect as of 1 January 2022;

- to reduce the tax burden for low value properties;

- to maintain the 30% reduction of the total ENFIA bill that was granted back in 2020 also for year 2022;

- to maintain the overall annual ENFIA bill of Euro 2.5 billion.

The main change is the abolition of the supplementary ENFIA for private individuals. However, the main ENFIA assessed to private individuals is anticipated to increase following the introduction of an additional tax component, the “tax per total property value”, and of a readjustment coefficient that applies under requirements.

The changes in a nutshell

1. Changes impacting private individuals and legal entities

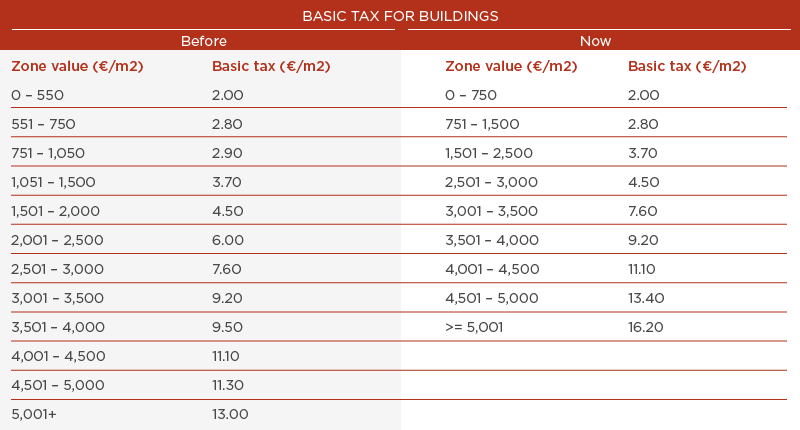

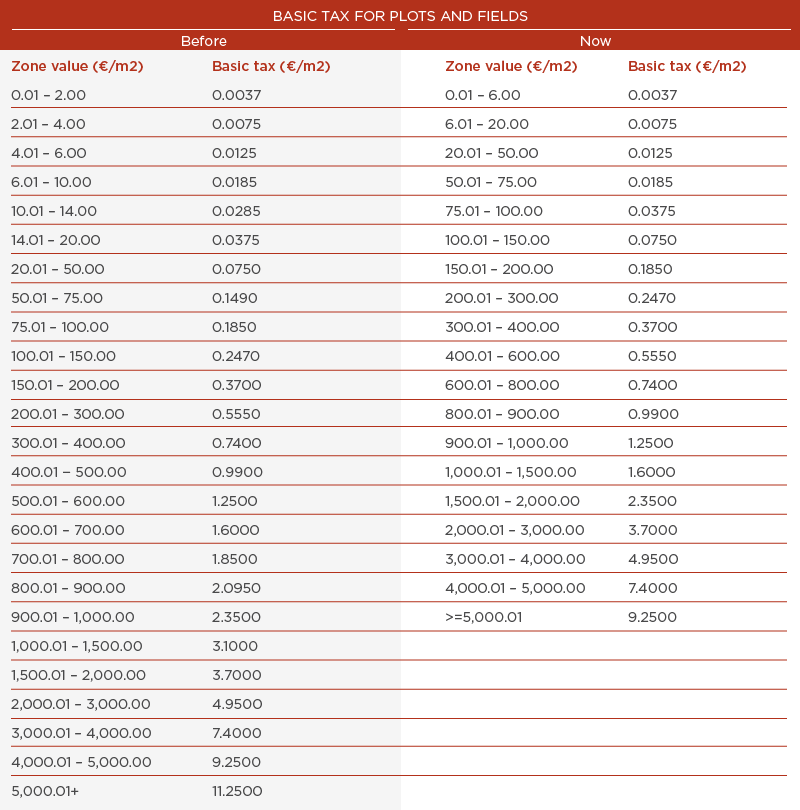

1.1. Changes in the main ENFIA tables with the basic tax amount (Euro per sq. m) for buildings and plots. Key take away: increases for buildings in “expensive” areas, reductions for plots.

1.2. New deadlines for updating the E9 forms; by the end of March instead of the end of May; exceptionally for 2022 the E9 filing can take place by 29 July without any penalty.

1.3. Assessment of the tax is expected to take place within April 2022, whereas the tax can be paid either one-off or in ten equal instalments, from May to February.

2. Changes impacting private individuals

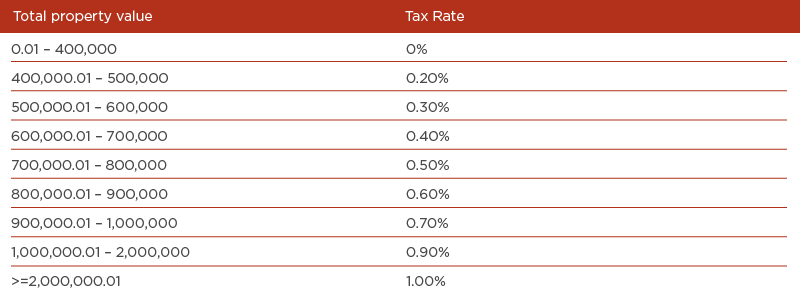

2.1. In Introduction of the “tax per total property value”, an additional main tax component for properties the value of which exceeds Euro 400K.

2.2. Introduction of readjustment coefficients on the amount of the main ENFIA for private individuals, owners of total assets exceeding Euro 500K.

2.3. Abolition of supplementary ENFIA for private individuals.

3. Main tax; impact for all taxpayers

Both private individuals and legal entities may see their main ENFIA bill change (be lower or higher) following the changes in the zone value of their properties (as applicable on 1 January 2022) resulting from the recent statutory value changes and the new basic tax amounts per zone value as per the tables below:

4. Impact for private individuals

Private individuals holding properties of a value exceeding Euro 400,000 per property, irrespective if such property is jointly held, will be burdened with an additional main ENFIA tax, the tax per total property value. Said tax is assessed το taxpayers owning properties of a total value exceeding Euro 300,000 (excluding plots outside town planning areas). The new tax is calculated as per the scale below:

Therefore, the total burden for individuals will consist of the main tax and the new tax per property value. Furthermore, a tax readjustment increasing the total ENFIA burden is introduced for individuals whose properties’ total taxable value exceeds Euro 500,000 (excluding plots outside town planning areas). The increase is levied as per the below progressive scale:

On the other hand, the application of the reductions afforded to individuals since 2019 on the total property value is now limited to individuals with total property value up to Euro 400,000.

5. Statutory values update

By way of reminder, the readjusted statutory values that entered into force on 1 January 2022 are the actual reason behind the ENFIA remodeling presented above. A brief update on this issue has as follows:

Statutory values changes – what happened and what to expect

The bridging of the statutory values with the market values has been on the table since the commencement of the Greek crisis and is still among the top items of the tax agenda during the period of the enhanced surveillance. Previous readjustment for areas within town planning was implemented back in 2018 and the most recent one in May 2021 with the new zone values coming in force as from 1 January 2022. Within 2022, 3,900 new areas are anticipated to enter into the statutory value system. Furthermore, a new electronic system is currently being designed with the set-up of a digital platform to collect data from all real estate transactions (sales, expropriations, leases) on real time and to facilitate, in the future, the faster and fairer update of the statutory values in all areas.

Areas impacted by the recent changes

The areas impacted from a geographic perspective by the recent changes are limited. This is because the readjusted values apply only to plots and buildings within town planning areas. Impacted areas are those where zone values had been previously set, whereas 3,643 new areas were introduced in the system. However, zone values of land located outside the town planning, as is the case with many popular areas both on the mainland and on the islands, have not been impacted. Buildings outside town planning may be impacted for main ENFIA purposes only if the lowest zone value of the relevant municipality has changed. Zone values for land located outside the town planning remain unchanged since 2008.

Key takeaway

For impacted areas the zone values have been significantly affected. As a way of example with reference to the prefecture of Attica one out of ten zone values has increased by more than 50%. Only 4% of the zone values have decreased; those zone values that are below Euro 1,000 have decreased by 61%.

Electronic application helps you to see whether you are impacted

Click on the link to check out the zone value applicable to your property before and after 1 January 2022. You can enter your address in the white window on the top left hand corner. If you click on the window below you can alternate between the previously applicable values (2018) and the current ones (2021).