Security Alert

Partner

LEARN MORESenior Associate

LEARN MORESenior Associate

LEARN MOREA number of tax changes have recently been introduced in connection with real estate reporting formalities, the Unified Real Estate Tax (ENFIA) and real estate transactions. The most important change is undoubtfully the abolition of the joint liability of purchasers of real estate for specific tax liabilities of the sellers.

You may find below a summary of the recent changes and an update on the revised ENFIA that applies to private individuals and has resulted in tax disputes that are currently pending before Courts.

By means of a decision of the Governor of the IAPR (A. 1033/2023) the deadline for filing the E9 return for reporting new property rights or for amending property rights referring to 1st January 2023 is extended from 31st March to 12th April.

By means of a decision of the Governor of the IAPR (A. 1035/2023) minor changes have been introduced in the E9 return as from 1st January 2023, which require however for some taxpayers to revisit and update their E9 returns.

Relevant taxpayers are those who hold:

- bare ownership rights,

- buildings that have been purchased off the plans by their developers and

- properties that are situated in Special Spatial Development Plans for Public Property under Law 3986/2011 and Integrated Development Plans under Law 4062/2012.

Until the Law enactment, purchasers of real estate properties were jointly liable with the seller for past seller’s tax liabilities from the annual ENFIA and from gift and/or inheritance taxes corresponding to the real estate transferred. The new law abolishes purchaser’s joint liability for transactions signed as from its publication.

Furthermore, no certificate will need to be collected by the seller to certify that the gift and inheritance tax corresponding to the property has been paid. The collection of such certificates was known to cause significant delays.

Taxpayers are entitled to amend their E9 return until 30th June 2023 without incurring the Euro 100 penalty for delayed filing. The payment of the ENFIA will be still made in instalments up until the end of February. A quasi-similar provision allowing for delayed amendments of the E9 return without the imposition of penalty had also applied last year.

The recently enacted Law provides that the reductions to the basic tax for the purpose of computing that main ENFIA that applied for FY 2022 will also apply, under requirements, for FY 2023. Namely properties that fall within tax zones 2 and 3 (i.e. with basic tax of 2.80 and 3.70 Euro per sq. met) will be taxed with the basic tax that corresponds to tax zones 1 and 2 instead (i.e. with basic tax 2 and 2.80 Euro respectively). This will apply to properties located in areas where the objective value system applied on 1st January 2022 provided that the recent increases of such values did not exceed the amount of Euro 50.

As per the new tax Law the uploading of the transfer deed in the electronic platform “My Property” by the notary will digitally and automatically update the E9 return of the counterparties in the transaction, thus saving the parties of an additional obligation post-closing.

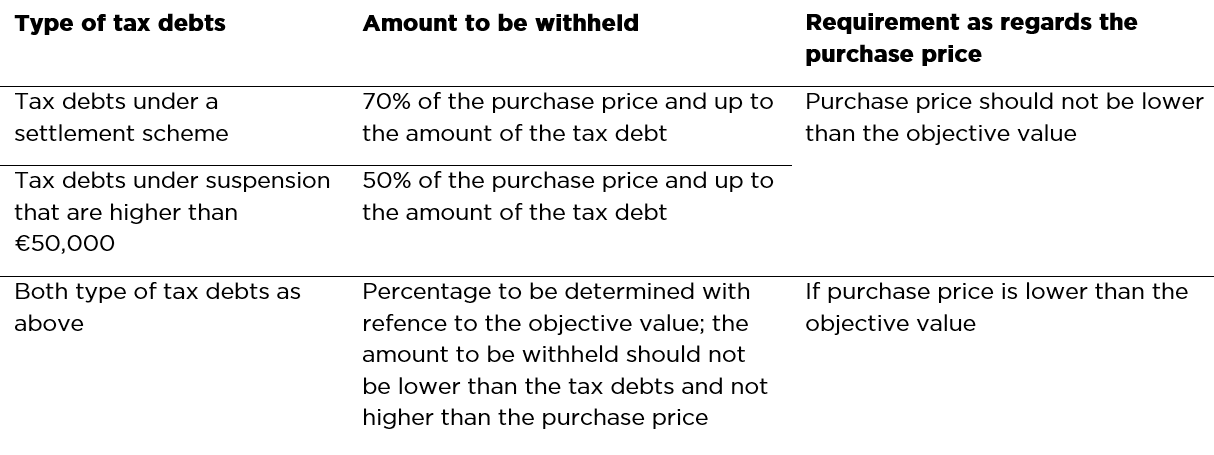

Taxpayers who have entered into a tax debts’ settlement scheme or have tax debts that are either not mature or are under suspension are entitled to obtain a tax clearance certificate with a maximum duration of one month.

In case that the tax clearance certificate is requested by a taxpayer for the purpose of real estate sale the tax clearance certificate provides that the following amounts will be withheld from the purchase price.

A joint decision of the Minister of Finance and of the Governor of the IAPR will provide for the procedure to be followed for obtaining the tax clearance certificate in the above cases and will determine the details for applying the percentages of the amounts to be withheld from the purchase price. The Governor of the IAPR is also authorised to determine by means of decision the amounts to be withheld from the purchase price in case that the taxpayer wishes to sell real estate and has outstanding but not mature gift and inheritance debts.

The most important changes that are relevant to the granting of the ENFIA clearance certificate that need to be attached both to the transfer deeds and the preliminary agreements for the transfer of real estates are the following:

In cases of deeds for the transfer or establishment of a property right irrespective of the legal ground of the transfer, the ENFIA clearance certificate to be collected should certify that the specific property has been reported in the ENFIA assessment of the previous five years, and not all the real estate of the same taxpayer, as had been the case before hence significantly facilitating real estate transactions.

The taxpayer can transfer the real estate even before the full settlement of the ENFIA corresponding to the specific real estate provided that the ENFIA certificate explicitly refers to the ENFIA amount and to the interests that are outstanding and that the notary shall remit equal amounts to the tax administration within 3 working days from the execution of the deed, otherwise relevant deed would be null and void.

In cases of deeds for the acceptance of inheritance rights the ENFIA certificate that corresponds to the period that the deceased was liable to the ENFIA can be collected by the interested heir provided that the ENFIA corresponding to the percentage of the rights inherited by the interested heir has been paid.

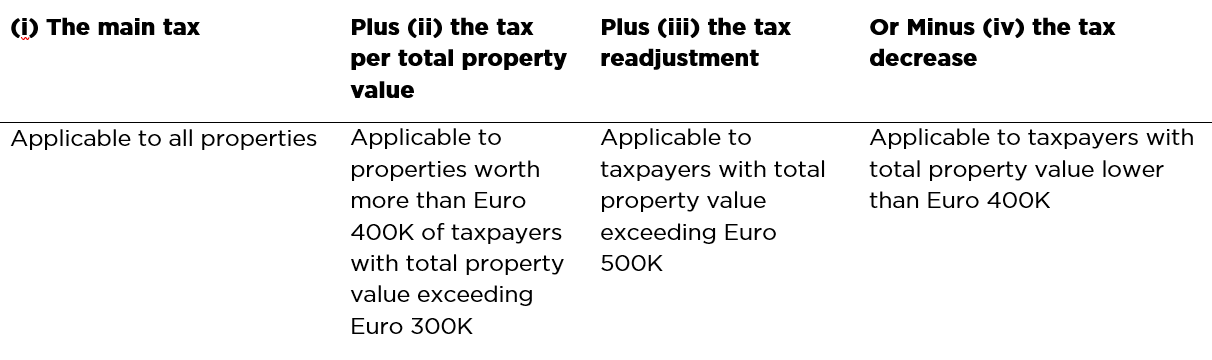

As a reminder starting from 1st January 2023 different rules apply for the computation of the ENFIA of private individuals and legal entities. The ENFIA of private individuals is computed on the basis of the formula below whereas no supplementary ENFIA is assessed any more.

In particular, properties worth more than Euro 400,000 that are held by private individuals are subject to an additional ENFIA burden (see item ii above) that is computed based on taxable brackets on the value of the property that is in excess of Euro 400,000, ranging from 0.2% to 1%, increasing thus proportionally the overall ENFIA burden. As a result, taxpayers that hold properties of equal total value that are in the same location may be taxed differently depending on whether they hold properties whose value exceeds Euro 400,000. A number of taxpayers who have seen their ENFIA bills being increased as a result of the ownership of properties whose value exceed Euro 400,000 have appealed against their 2022 ENFIA assessment act claiming that above different tax treatment infringes article 4 of the Greek Constitution, being thus incompatible with the principles of equality and taxable capacity regarding tax burdens. Relevant appeals had been brought initially before the Dispute Resolution Directorate and following their rejection on the ground that such Directorate cannot rule on matters of constitutionality are currently pending before Courts.