Security Alert

Partner

LEARN MOREPartner

LEARN MORESenior Associate

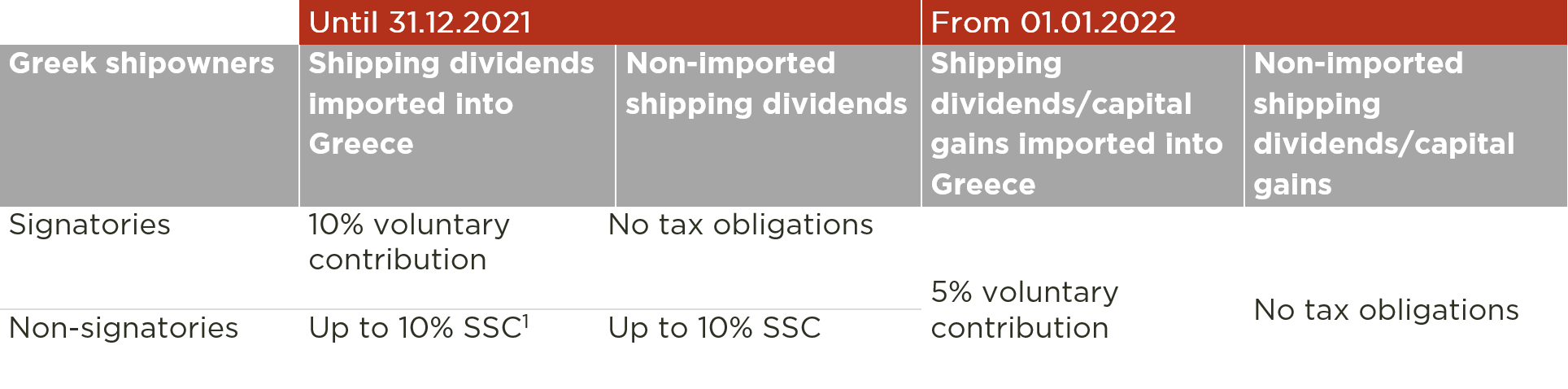

LEARN MOREThe Greek Parliament has ratified an addendum to the 27 February 2019 voluntary contribution agreement between the Government and the Union of Greek shipowners. By way of reminder, the 2019 agreement was adopted in the light of the Commission’s investigation on the compatibility of the Greek shipping taxation regime with EU State Aid rules. At that time, the agreement provided for the imposition of a 10% voluntary contribution on shipping dividends imported in Greece. Payment of the contribution was agreed to exhaust the shareholders’ tax liabilities with respect to their worldwide shipping income. Non-signatories to the 2019 agreement were subject to ordinary tax rules i.e. the special solidarity contribution that applied at that time at a rate of up to 10% on tax exempt income, including shipping dividends, irrespective of whether they were imported into Greece or not.

The Commission’s investigation from an EU State Aid rules’ perspective has been ongoing since then. In this context, the Greek Government is now entering into a revised agreement with the Union of Greek shipowners, aiming to meet the Commission’s concerns and therefore finalise the ongoing investigation. The revised agreement is reflected in the form of an addendum to the 2019 agreement and is set to apply from 1.1.2022. It provides for the reduction of the voluntary contribution rate from 10% to 5%, while extending the scope of application of the voluntary contribution to cover not only dividends, but also capital gains from shipping shares, when imported into Greece. Payment of the contribution in question exhausts any Greek tax obligation with respect to the worldwide shipping income of the shareholders. The contribution is payable by Greek tax resident UBOs of ship owning companies, including bareboat charterer companies, whereas it is set to apply not only for signatory parties but also for non-signatory shipowners. This is under the condition that signatories represent more than 90% of the tonnage of the vessels managed in Greece.

In view of the above, the tax treatment of Greek tax resident UBOs earning shipping dividends and capital gains from 1.1.2022 onwards changes as follows:

The agreement provides that in the event that the total voluntary contribution collected by the Greek State during any given year is less than Euro 60,000,000, signatories as well as non-signatories of the new agreement will be required to pay the remaining amount to the State.

The long-standing tonnage taxation of Greek flag ships or non-Greek flag ships managed by companies established in Greece through a Law 27/1975 office is extended to time and voyage charterers. In particular, time and voyage charterers, which are also engaged in ship-owning and bareboat chartering activities, of fully equipped and staffed ships owned by other companies are subject to tonnage taxation provided that:

(a) either at least 25% of their total fleet flies the flag of an EU/EEA Member State or (b) the quota of time/voyage chartered ships not flying an EU/EEA Member State flag does not exceed 75% of the fleet, which is under their ownership and/or bareboat chartered.

Tonnage taxation applies for time and voyage charters from year 2023 onwards.

[1] SSC on dividends has been suspended for years 2020, 2021 and 2022 and has been repealed for years 2023 onwards.